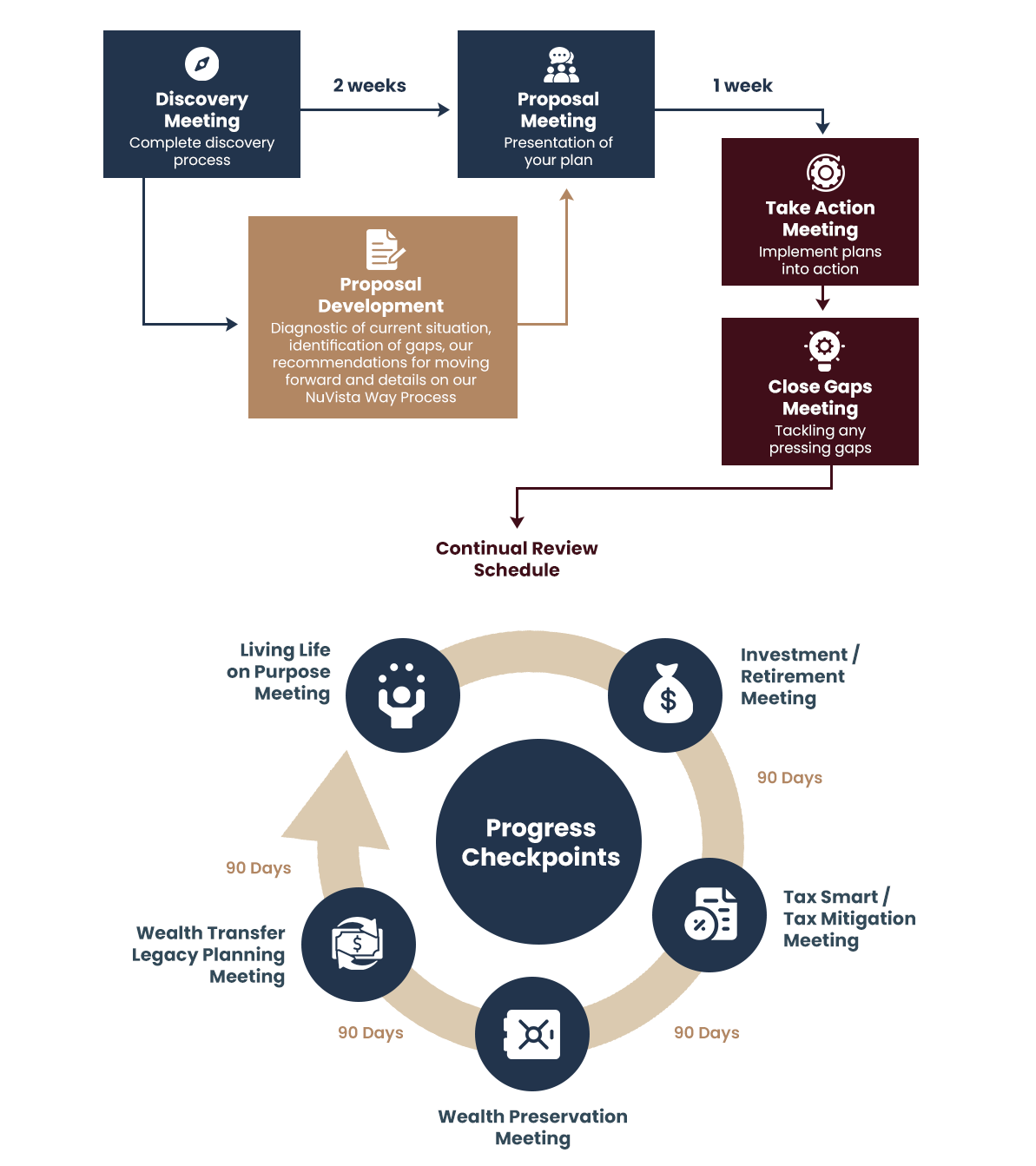

The NuVista Way™

Your path to financial freedom and fulfillment

Transforming your wealth into a life of purpose and passion requires a thoughtful, personalized strategy. At NuVista, our process helps you clarify your vision, craft a customized plan to meet your goals, and take action to bring that plan to life. Here’s how we make it happen.